louisiana inheritance tax waiver form

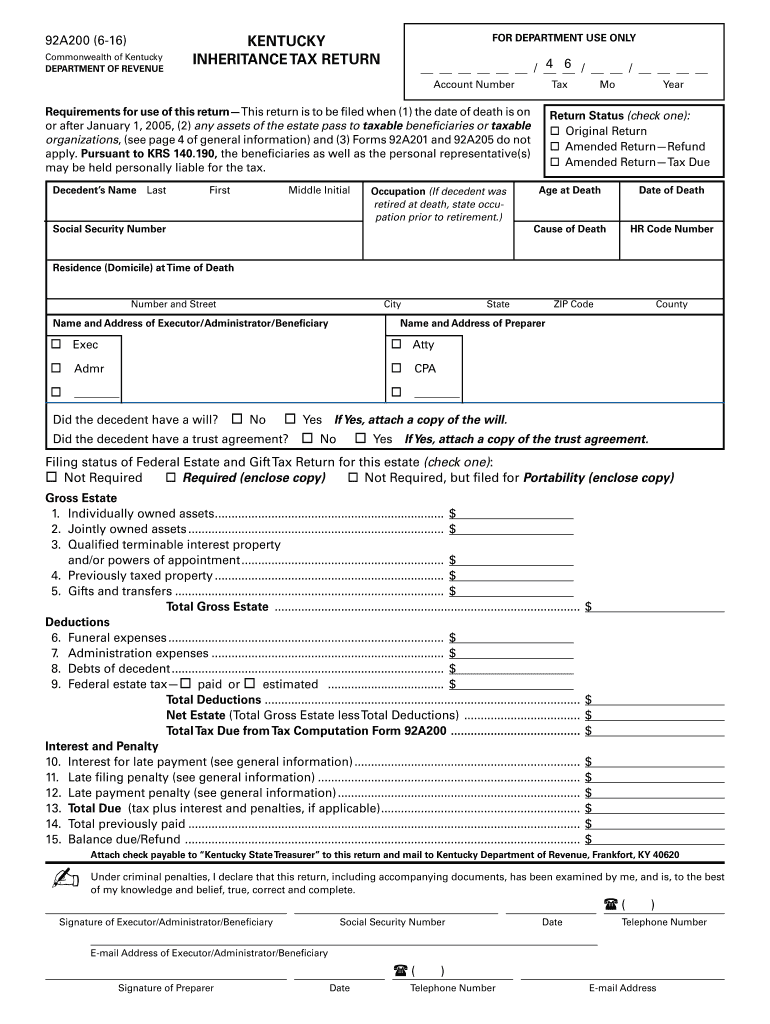

Estates with Louisiana property that is worth over 125000 will likely have to go through the probate process according to Louisiana inheritance laws. No inheritance tax is owed and theres no need to file an Inheritance and Estate Tax Return with the Louisiana Department of Revenue.

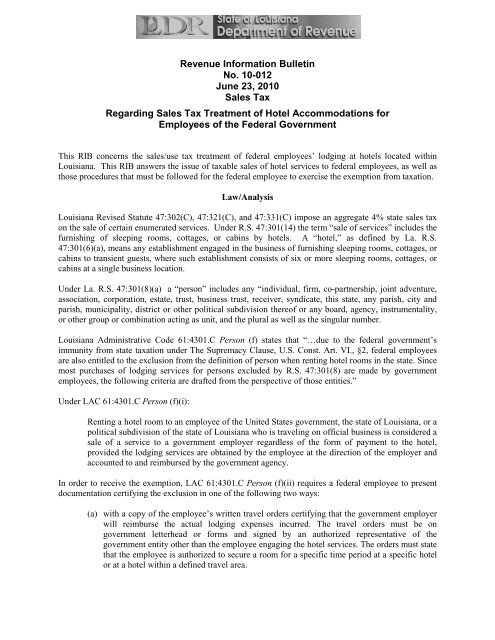

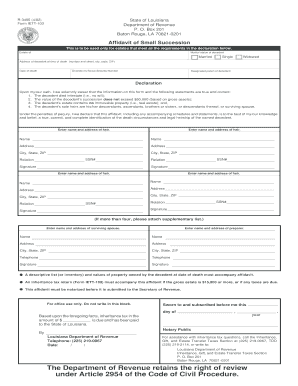

10 012 Louisiana Department Of Revenue

The failure to plan for.

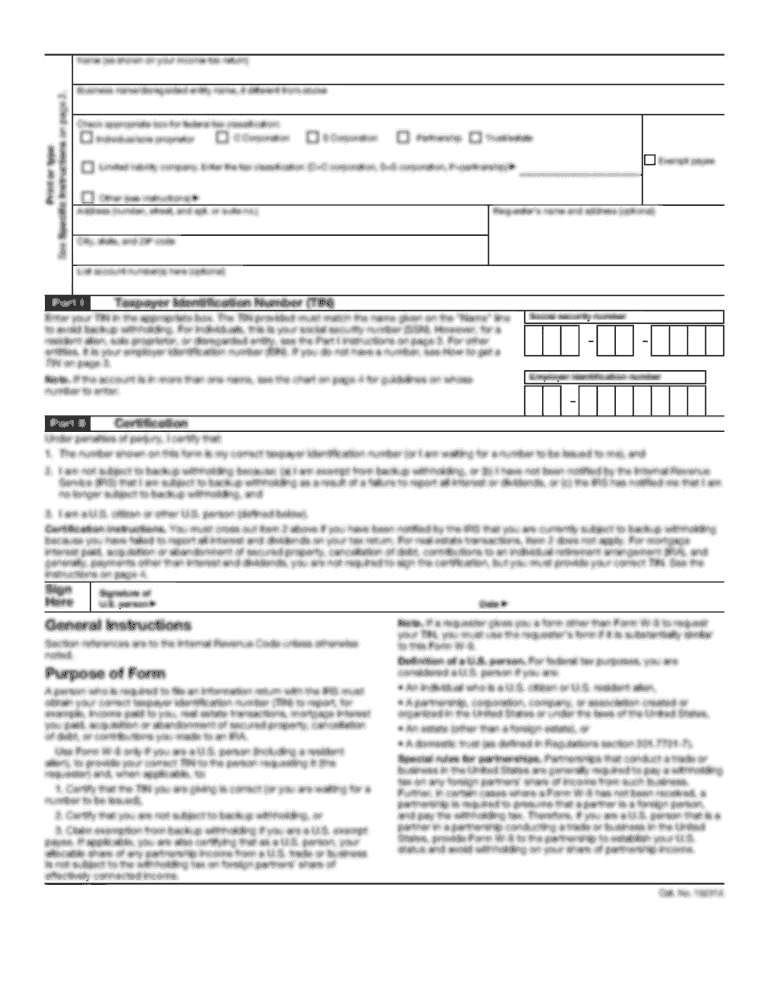

. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. A typed drawn or uploaded signature. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing.

Retirees get a 6000 annual exemption on these sources of. Dotax is intended to the state of inheritance tax waiver form but not be. The Economic Growth and Tax Relief Reconciliation Act of.

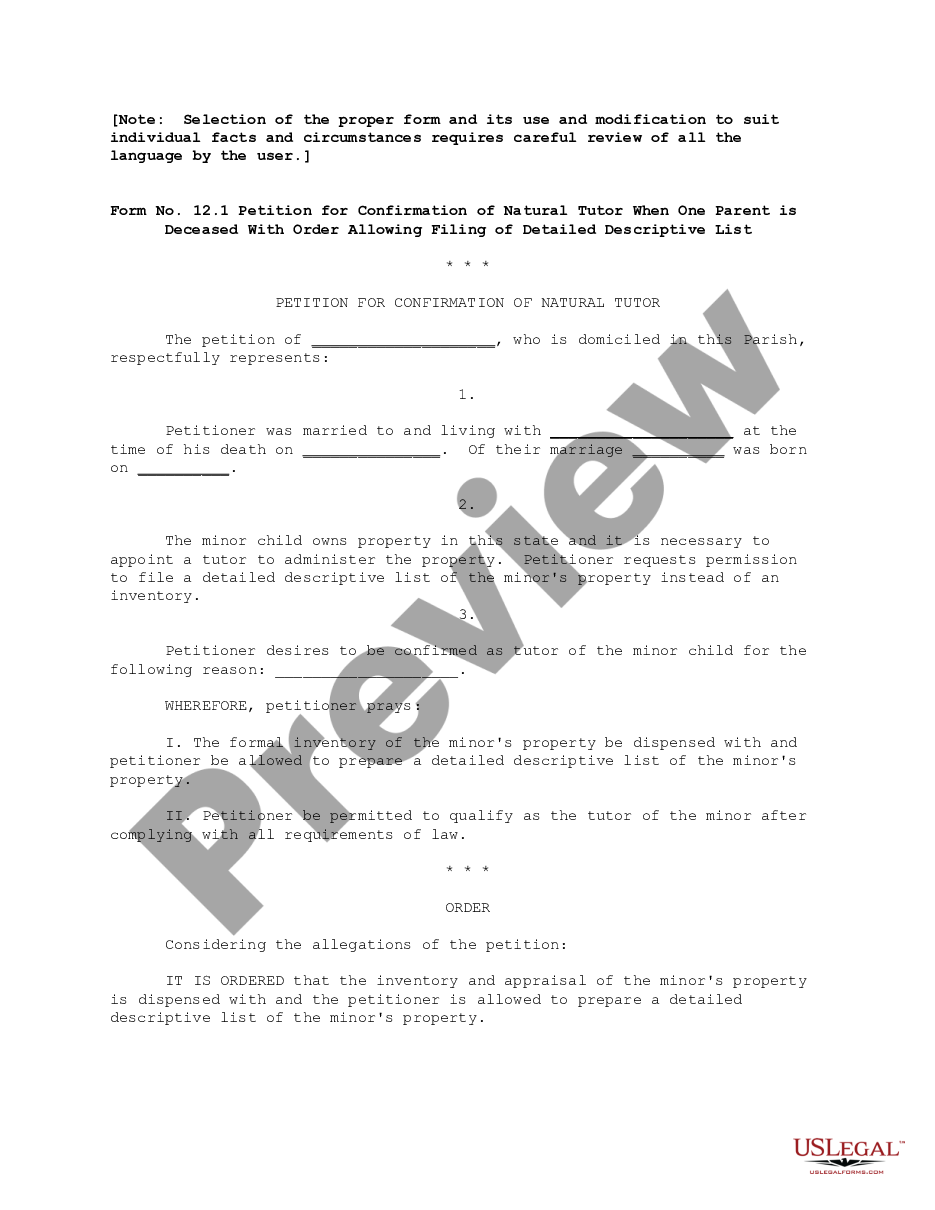

Decide on what kind of signature to create. 2022 Estimated Tax Voucher for Individuals. A signed duplicate original accompanied by copies of the documents required in Louisiana Code of Civil.

The irs will evaluate your request. What is an Inheritance or Estate Tax Waiver Form 0-1. Online applications to register a business.

Select the document you want to sign and click Upload. Access your account online. Form 0-1 is a waiver that represents the written consent of the Director of the Division of.

Inheritance tax An original inheritance tax return is to be filed in the succession record. File your clients Individual Corporate and. This ratio is applied to the.

Inheritance Tax Waivers must be filed with the County Clerks Office to show that the property is clear of all taxes. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate. Effective January 1 2012 no receipts will.

Fill Free fillable Louisiana Real Estate Commission PDF forms from fillio. File returns and make payments. REV-346 -- Estate Information Sheet.

Probate is there to. REV-485 -- Safe Deposit Box Inventory. Does Louisiana impose an inheritance tax.

There are three variants. REV-229 -- PA Estate Tax General Information. Louisiana Administrative Code 61III2101B provides that before a request for waiver of penalties can be considered the taxpayer must be current in filing all tax returns and all.

Request for Waiver of Penalties Louisiana Department of Revenue PO. Find out when all state tax returns are due. It partially taxes income from private pensions and withdrawals from retirement accounts like 401k plans.

How do you get a tax waiver. No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS. Inheritance Tax Waivers The Essex County Clerks Office.

Box 201 Baton Rouge LA 70821-0201 Louisiana Administrative Code 61III2101B provides that before a request for. Division of Taxation. 1 Inheritance tax due From Line 7 Schedule IV 2 Estate transfer tax From Line 8 Schedule IV 3 Interest due on inheritance and estate transfer taxes See instructions 4 Total amount due.

The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. In its most basic form separate property is everything that isnt. What you must do.

In fact as discussed below the Louisiana Department of Revenue has stopped issuing receipts It is unclear whether people who died on or before June 30 2004 will be subject to inheritanc See more. REV-487 -- Entry Into Safe Deposit.

Where S My Refund Louisiana H R Block

Louisiana Wills What You Need To Know Louisiana Family Criminal Immigration Lawyers

Form 92a200 Fill Out Sign Online Dochub

Estate Taxes Under Biden Administration May See Changes

Forms Louisiana Department Of Revenue

Louisiana Packet To Appoint Natural Tutor Under Tutorship Louisiana Us Legal Forms

Louisiana Small Succession Affidavit Fill Out And Sign Printable Pdf Template Signnow

10 Ways To Reduce Estate Taxes Findlaw

Will I Have To Pay Taxes On My Inheritance Sessions Fishman Nathan L L C

States With No Estate Tax Or Inheritance Tax Plan Where You Die

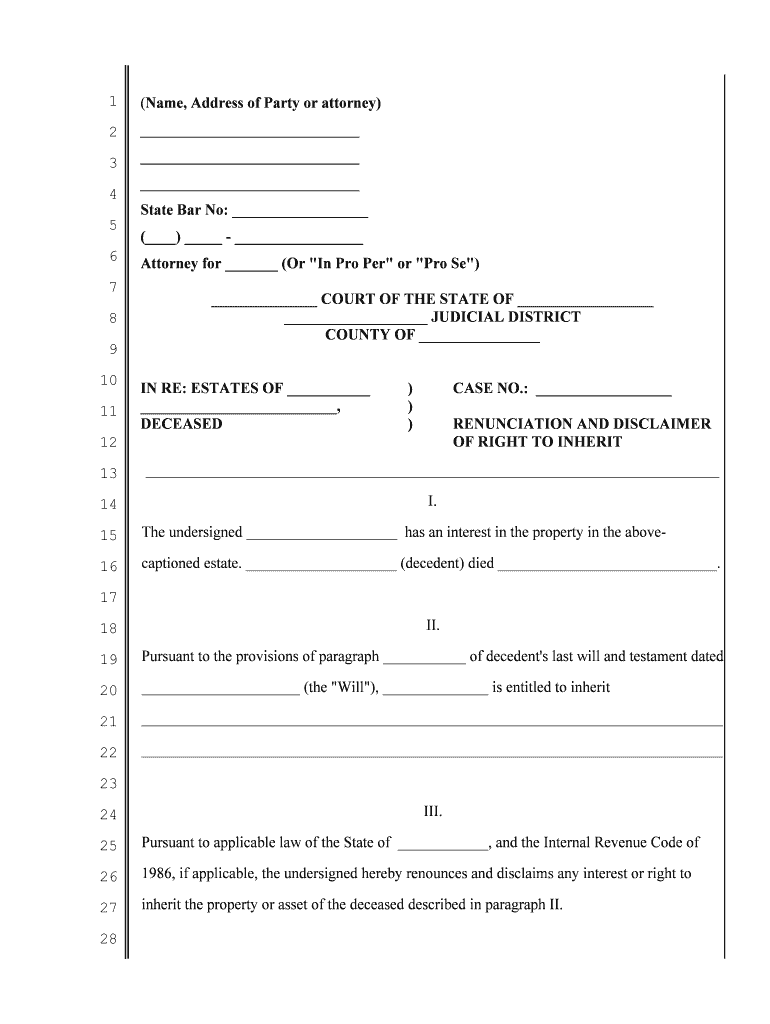

Renunciation Of Inheritance Form Fill Online Printable Fillable Blank Pdffiller

Free Louisiana Power Of Attorney Forms Pdf Word Downloads

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

How Intestacy Affects Inheritance And Succession In Louisiana Family Law Criminal Defense Personal Injury The Law Office Of Chris Stahl

Free Louisiana Quitclaim Deed Form Legal Templates

Renunciation Of An Inheritance In Louisiana Scott Vicknair Law

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

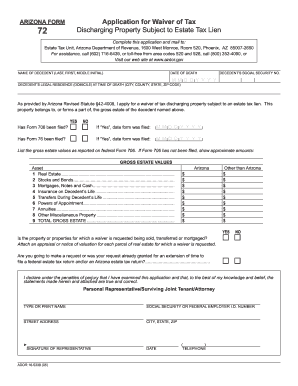

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Nj Division Of Taxation Inheritance And Estate Tax Branch Waivers